Welcome to the Monthly Market Shakedown for May 2025 — your straight-shooting breakdown of what's happening in the national and Jacksonville real estate markets. Whether you're buying, selling, or just keeping tabs, this month’s data brings key updates and opportunities you don’t want to miss.

Mortgage Applications Spike, But Rates Are a Mixed Bag

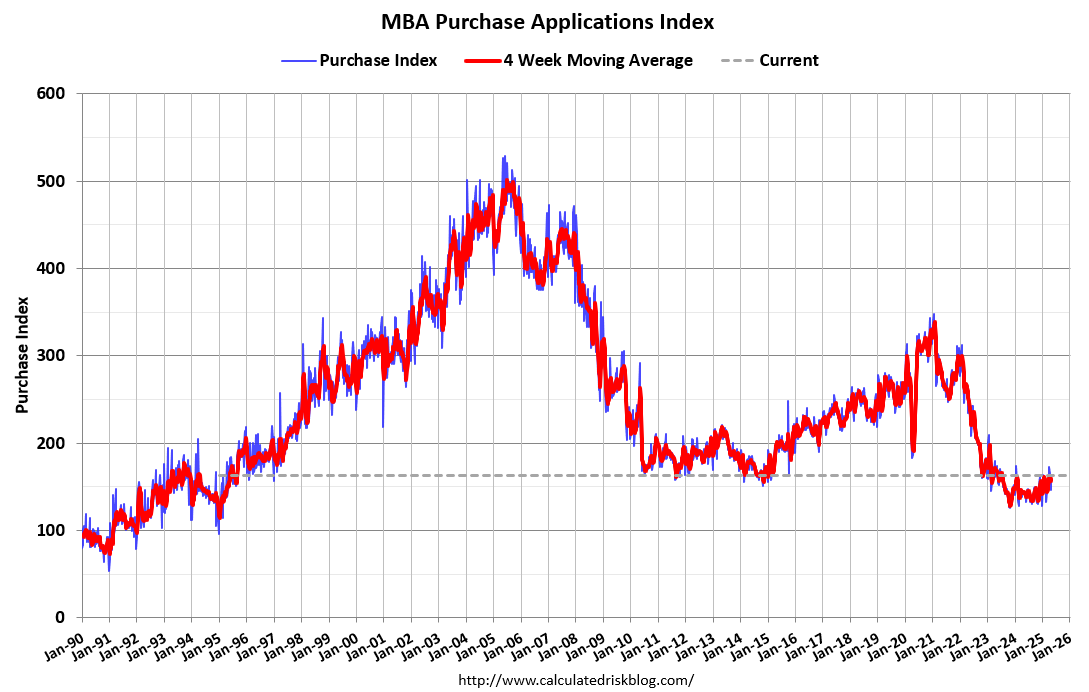

According to the Mortgage Bankers Association, mortgage applications rose 11% in the week ending May 2nd. That’s a clear signal of increased buyer interest.

However, rates are still giving us whiplash. The week closed with rates only slightly lower, with improvements linked to speculation around U.S.-China trade talks. As Matthew Graham of Mortgage News Daily put it, the rate drop was a mere “hair lower,” due to some positive trade headlines.

Unfortunately, we’re not out of the woods yet — Fed Chair Jerome Powell ruled out a preemptive rate cut in light of potential tariff impacts. With the Fed holding steady at a target range of 4.25% to 4.5%, volatility is still the name of the game.

National Housing Market Snapshot

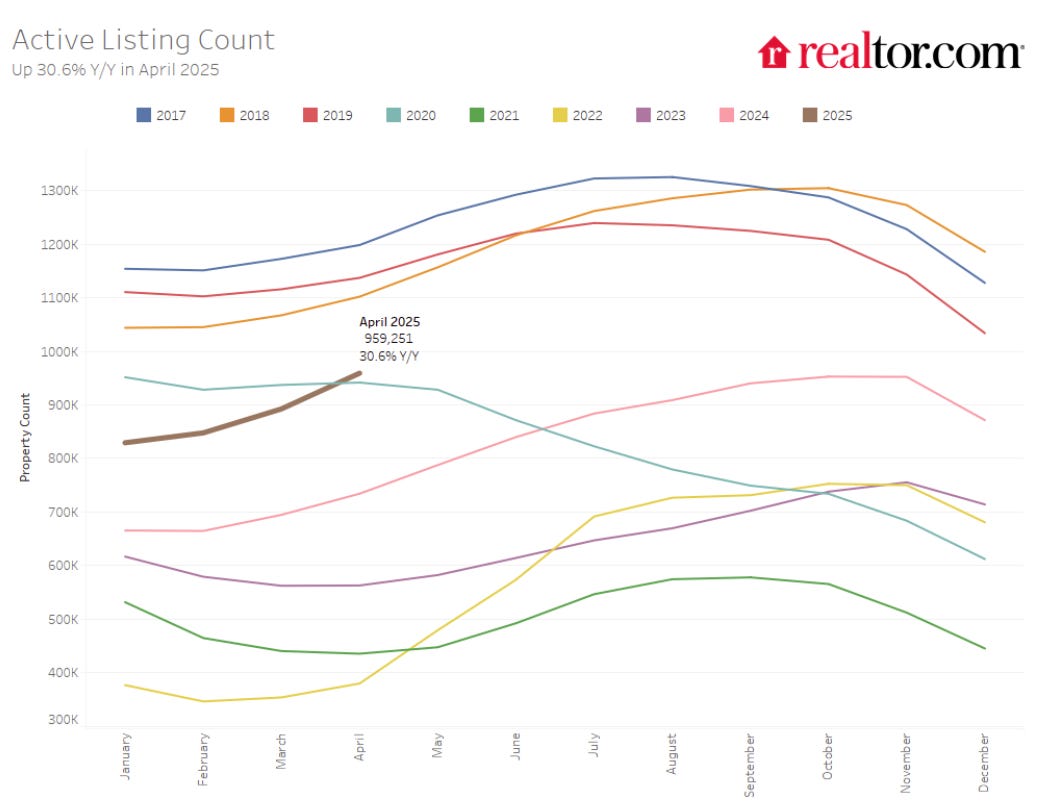

From a high-level view, housing inventory is climbing — but it hasn’t returned to pre-pandemic norms. According to Calculated Risk, new listings are up 9.2% year-over-year, and active inventory jumped 30.6% — encouraging signs for buyers. Still, we’re 16.3% below 2017-2019 inventory levels, so selection remains somewhat limited in many areas.

Meanwhile, investors are cautiously optimistic as U.S.-China trade talks showed progress. Though no firm details have been released, stock futures rose in response, and Treasury yields remain in focus for future rate trends.

Jacksonville Market Breakdown

Let’s zoom in on our hometown.

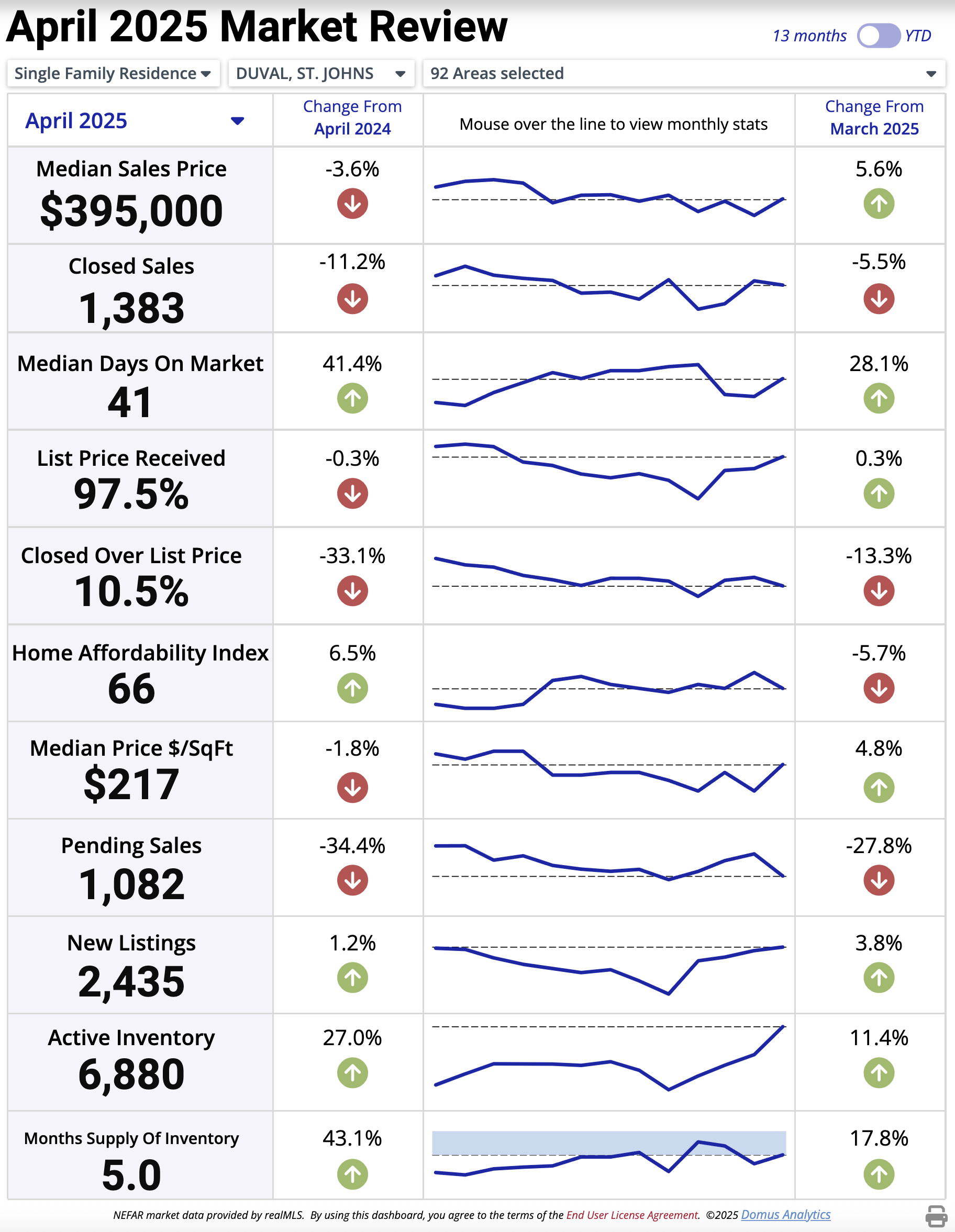

According to the latest NEFAR Market Review (April 2025):

-

Active inventory in Duval & St. Johns counties is up 27% YoY

-

New listings are up 1.2% YoY

-

Pending sales are down a sharp -34.4% YoY

-

Median sales price has dropped to $395,000, a -3.6% decrease from April 2024

The bottom line? Jacksonville has officially transitioned from a balanced market to a buyer’s market.

Statewide, Florida is one of just nine states where inventory levels are above pre-pandemic norms. Jacksonville is also among only 69 of 200 major markets that have exceeded 2019 inventory levels.

What This Means for You

Buyers: This is your moment. With increased inventory, declining median prices, and motivated sellers, you have more leverage and more choices. The relationship between your realtor and lender is absolutely crucial right now — and that’s where my team comes in.

Sellers: While the market has shifted, your success hinges on preparation and execution. Here's what gets homes sold today:

-

Expert Exposure – A 20-step marketing strategy that gets results

-

Strategic Pricing – Price it right, and the buyers will come

-

Pristine Condition – Stand out from the competition

In today’s market, who you hire truly matters.

Let’s Make Your Move

Whether you're buying your dream home or selling to move up, you need a team that understands both the macro shifts and the hyper-local trends.

📞 Let’s talk strategy.

📧 Contact me directly through riggsgroupfl.com or click the link in the footer to schedule your free consultation.

Don't wait — smart moves are made with the right team.