Thinking about putting down roots in Jacksonville but feeling lost in today’s real estate landscape? You’re not alone. In this post, we’re diving into the local and national housing market, unpacking buyer-friendly strategies, busting VA loan myths, and giving both buyers and sellers a roadmap to win in 2025.

Recently, I sat down (again!) with my friend and mortgage pro, Trevor Harrington of Future Home Loans—yes, again, because the first time we forgot to hit record on his mic! But we came back with even more value, so let’s break it down.

National Housing Market: What’s Going On?

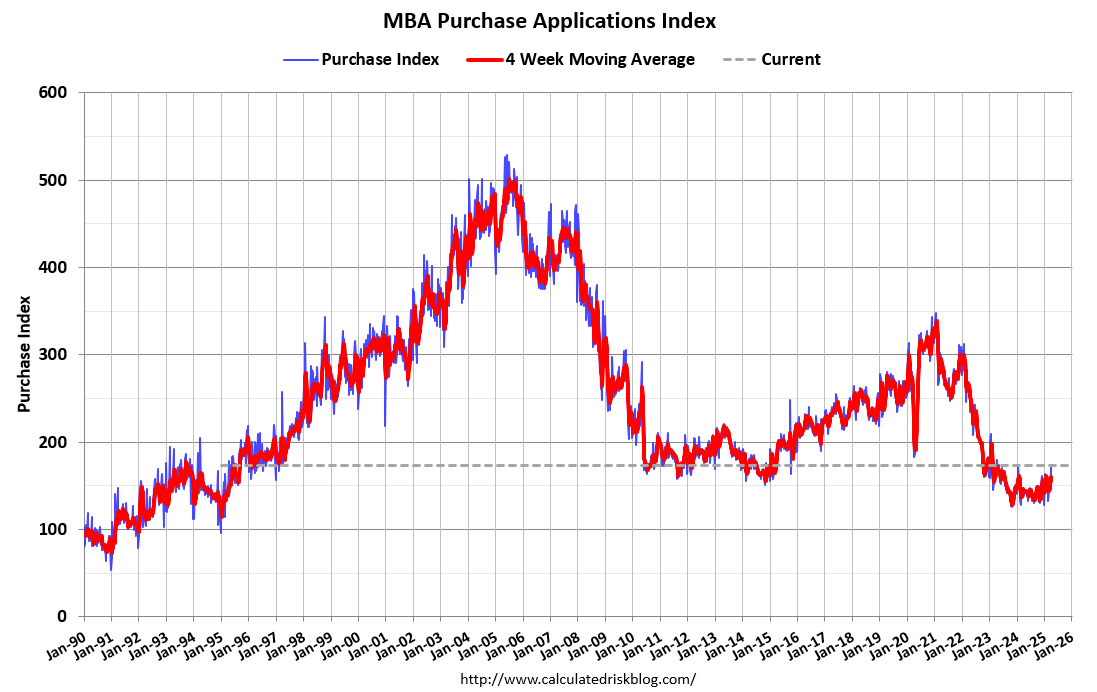

According to the latest data from the Mortgage Bankers Association (MBA), mortgage applications jumped 20% in early April—the biggest spike since January 2025. That’s a strong sign that the market is heating up heading into summer. Even refinance applications were up, with 40% of applicants looking to refi.

What’s this mean for buyers in Jacksonville? According to Trevor, rates have recently dipped from their winter highs, and while they’re bouncing a bit due to global events, they’re still attractive. Bottom line: it’s a great time to jump in before competition ramps up.

Northeast Florida: More Homes, More Opportunity

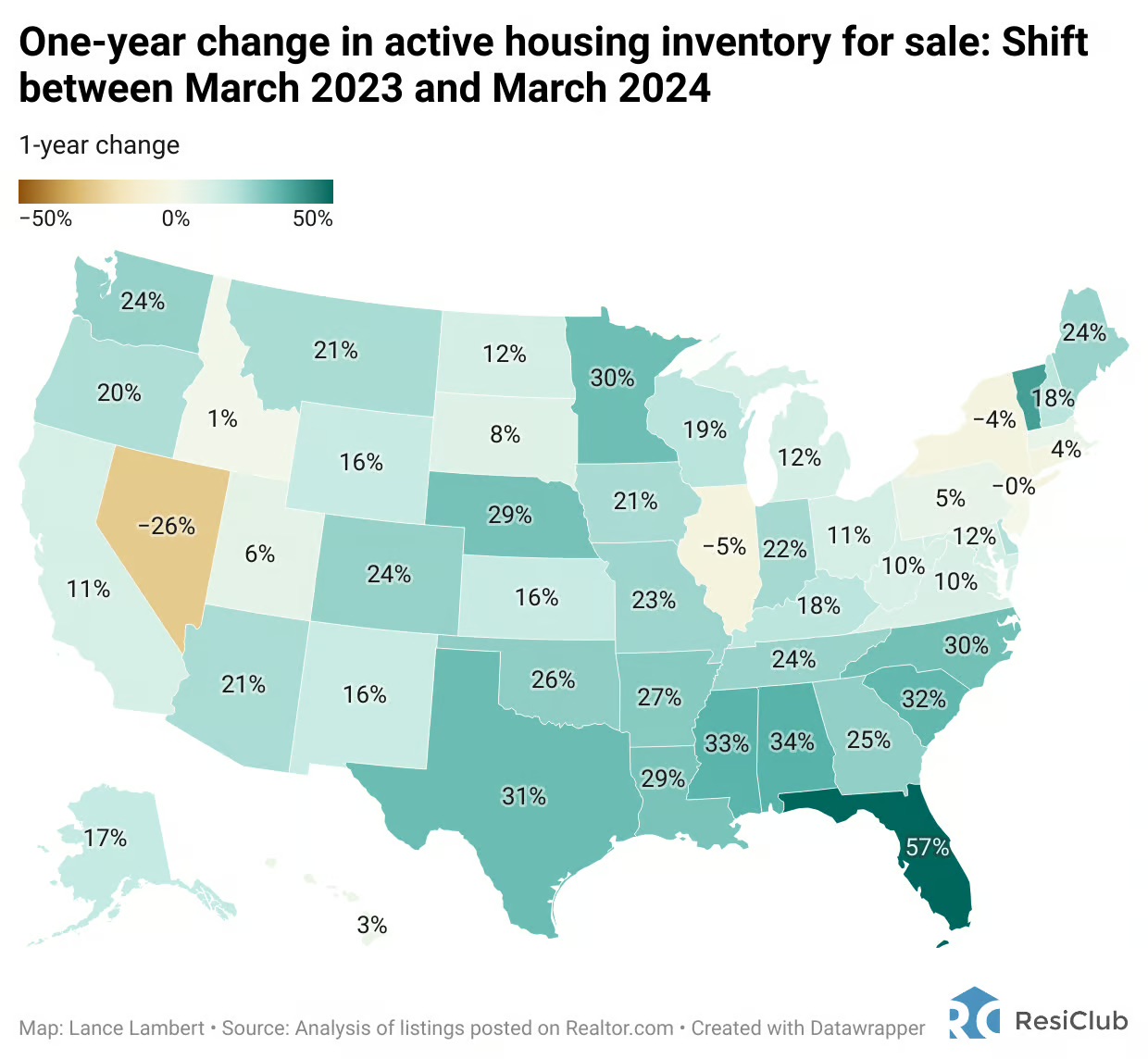

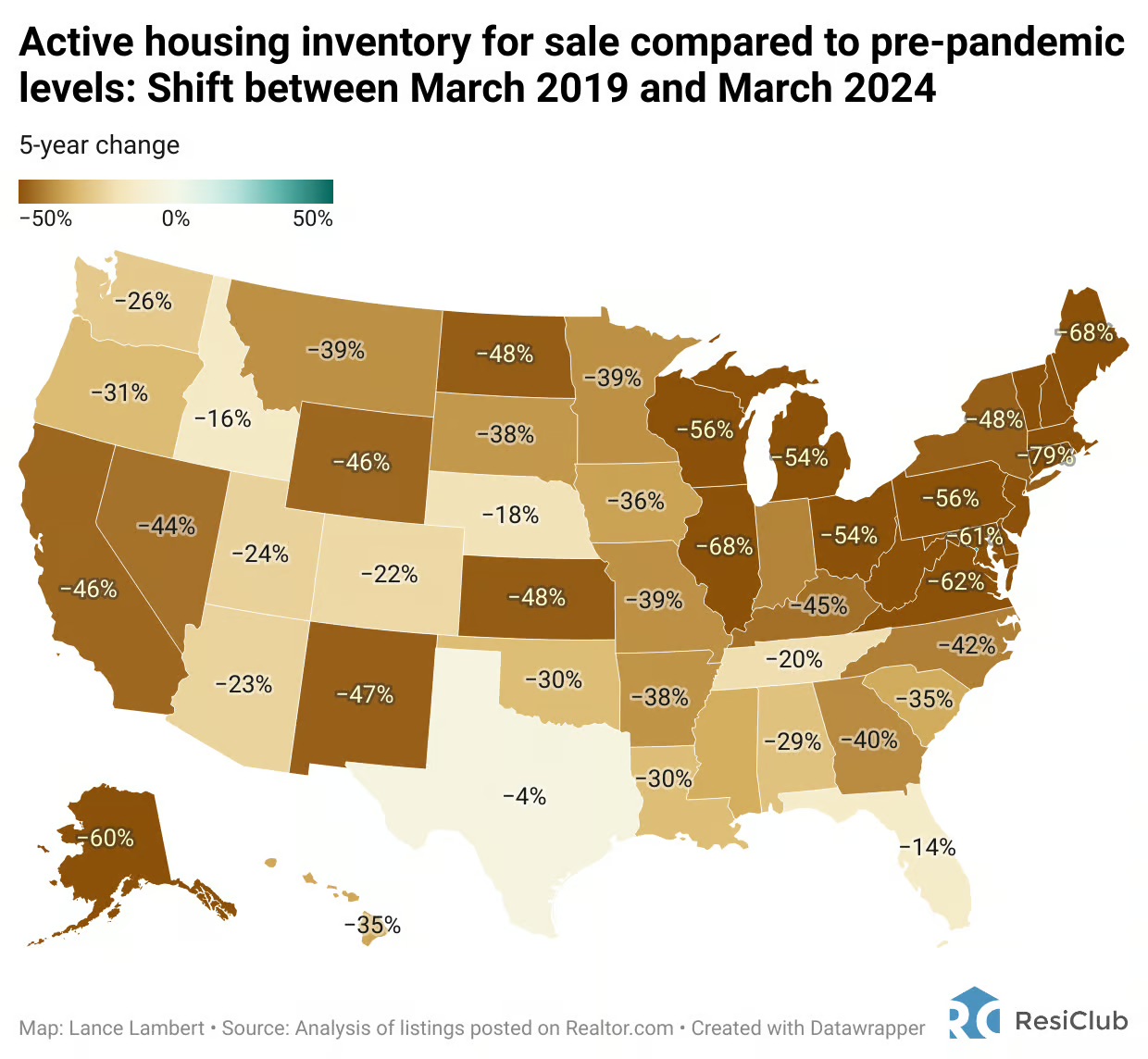

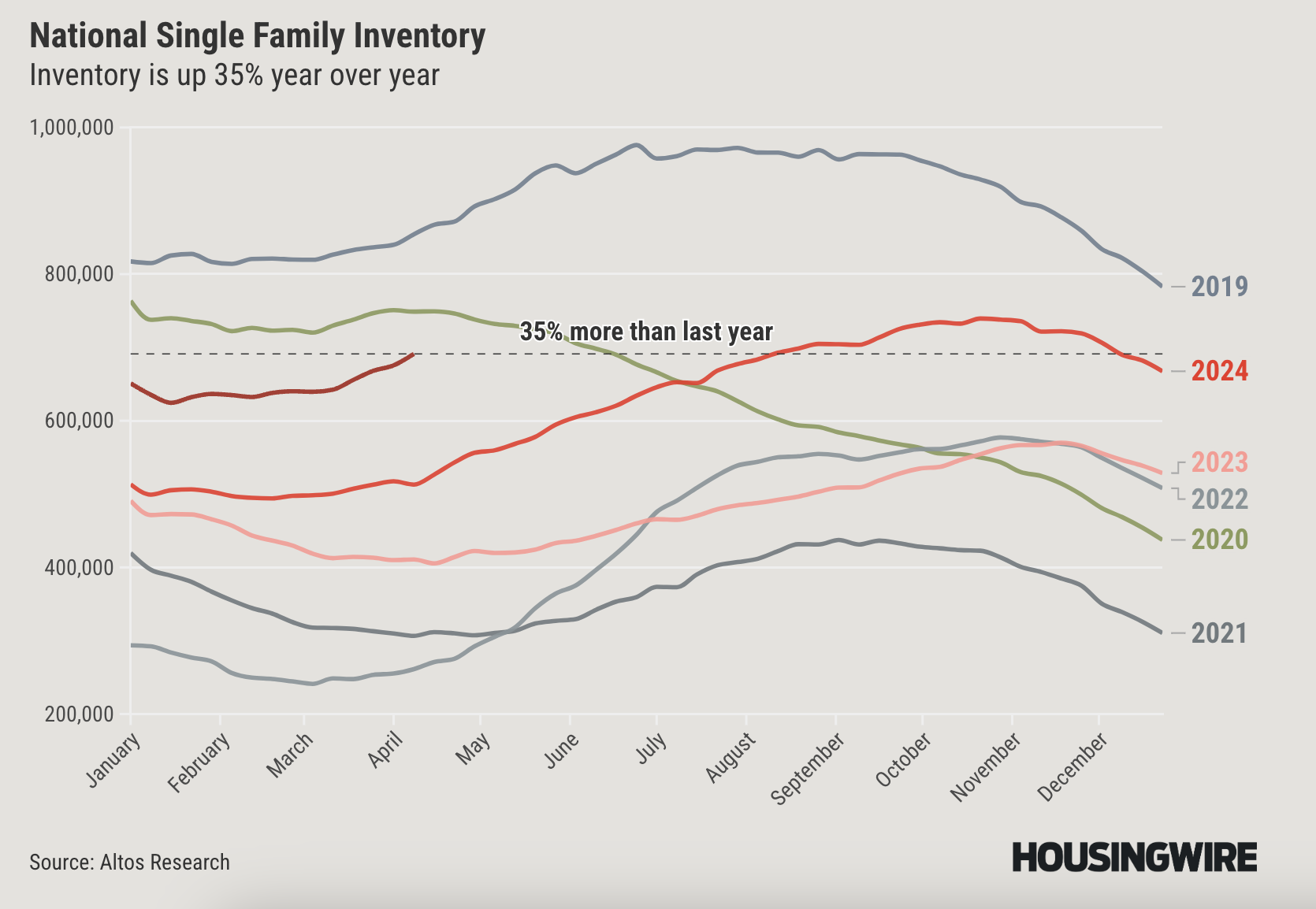

Yes, inventory in Jacksonville is up—66% in one month—but don’t panic. We’re still way below pre-pandemic levels. That means you’ve got more choices, but you’re not shopping in a flooded market. If anything, this is what a balanced market should feel like.

With longer days on market, buyers have leverage. But this window won’t stay open forever—when rates drop, competition comes roaring back. Get in now, negotiate like a pro, and refinance later (more on that below).

Special Advantage: The Power of the VA Loan

Jacksonville is home to two major Navy bases, so many of our clients are veterans or active duty. If you’re one of them, listen up:

-

VA Loans = 0% down.

-

You can refinance with a VA IRRRL (aka “IRRL”) without an appraisal or requalification.

-

You can own more than one VA-backed home at a time. That’s right, you can turn your current home into a rental and use the VA loan again in your new city.

Trevor and I are putting together a whole educational program around building wealth with VA loans. Stay tuned.

Not a Veteran? You Still Have Options

Worried about the down payment? You’re not alone. Future Home Loans has a variety of down payment assistance (DPA) programs, including:

-

Forgivable DPA after 5 years of ownership

-

Solar-based incentives (up to $13,000 off your down payment)

-

FHA options that can pair with seller concessions for low out-of-pocket costs

Trevor helped one recent client buy a home with almost zero out-of-pocket expenses after a financial emergency. There’s more flexibility than you think.

Think Long-Term, Not Short-Term

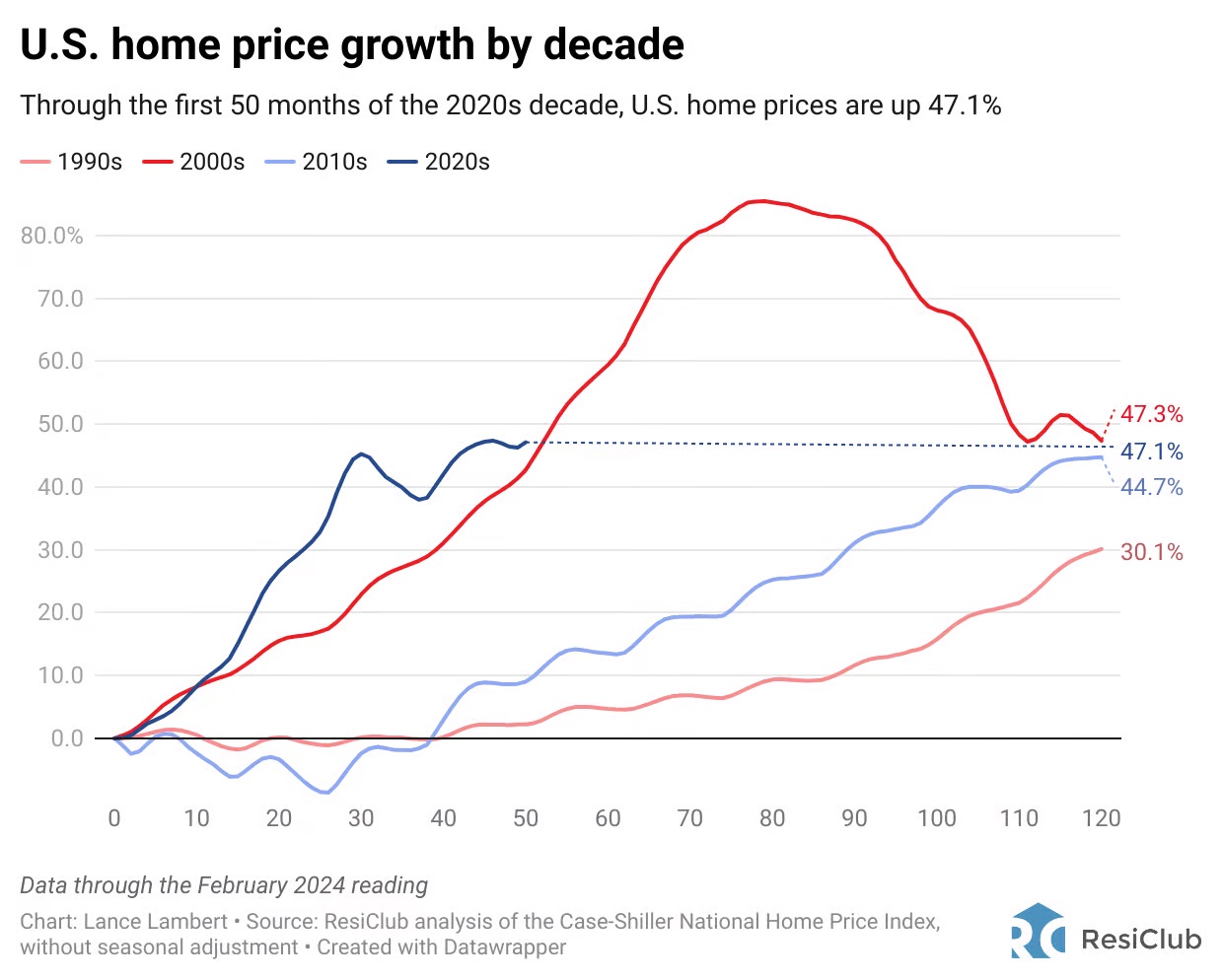

The headlines love to scream “Recession!” but history tells a different story:

-

In 4 out of the last 5 U.S. recessions, home prices rose or stayed flat.

-

The one exception? The Great Recession of 2008, which was caused by the housing market.

This time is different. Housing isn’t the problem; it’s the safe haven. And homes in Jacksonville have appreciated significantly over time. One of my clients, for example, averaged 8.4% annual appreciation by just living in her home since 2012.

Sellers, It’s Your Market Too—But You’ve Got to Be Smart

If you’re a seller in Jacksonville, listen closely:

-

Condition, price, and exposure are everything.

-

One in three listings is expiring right now.

-

Buyers are picky. Your home needs to shine and be priced right.

The good news? Most sellers still have tons of equity and low interest rates. So while the market has softened, you’re not under pressure—just be strategic and let a pro handle the marketing.

Key Takeaways for Buyers

-

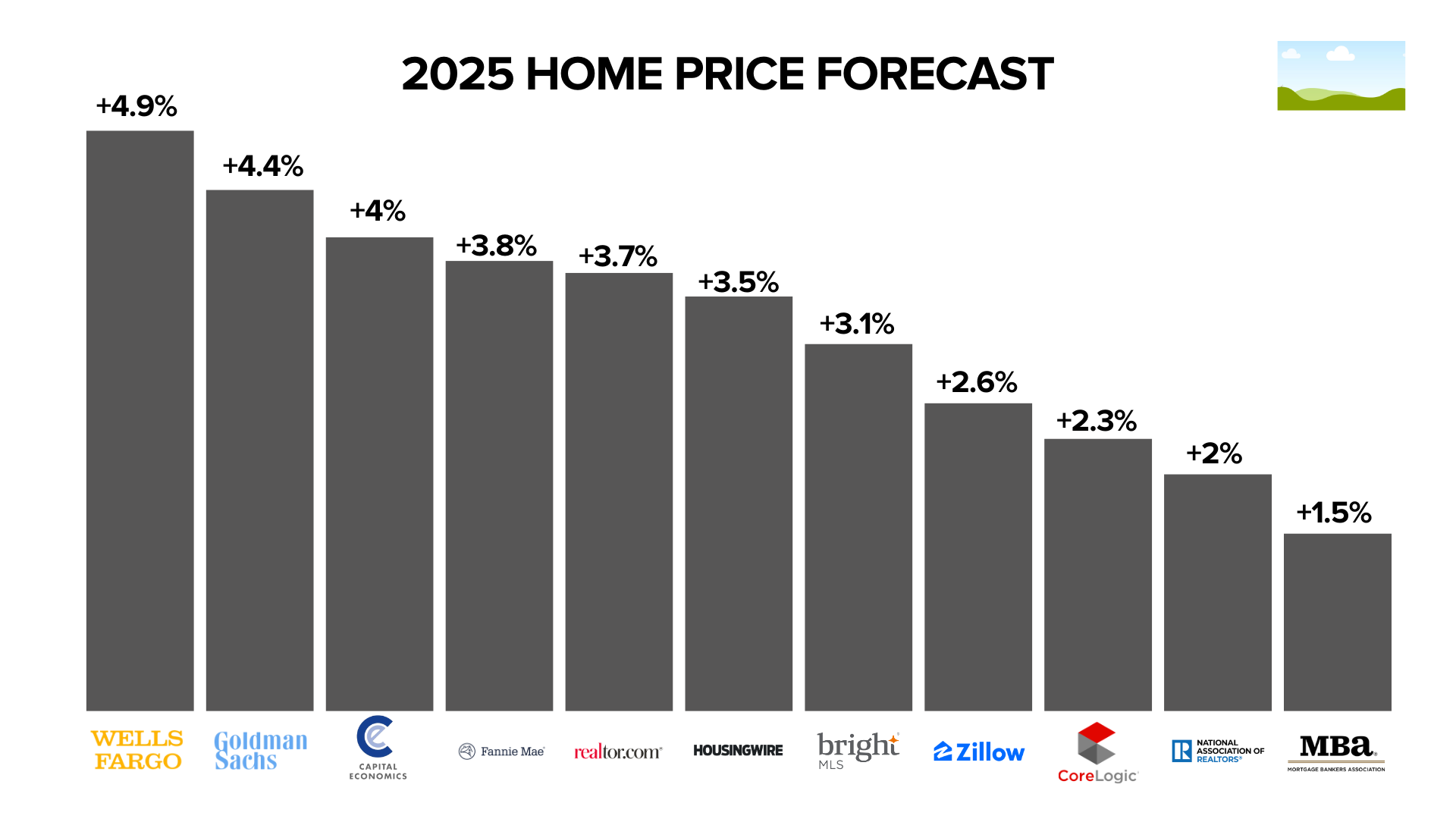

Don’t wait for rates to drop. Buy now, refinance later with a VA IRRRL or traditional refi.

-

Inventory is up, but not overwhelming. You’ve got time to shop smart.

-

Work with a team (like Trevor and me) that communicates regularly and looks out for your financial health.

-

Own for 7–10 years? You can’t lose. Homeownership beats renting every time.

-

Use your benefits. VA loans, DPAs, seller credits—we’ll help you use them all.

Save the Date: Riggs Group Beach Fest – June 8th

Come hang out with us on June 8th at Sunshine Park in Jacksonville Beach. We’re hosting a FREE family-friendly event with food, splash pad fun, and a beach day. Register here to reserve your spot.

Ready to Talk Real Estate?

Whether you’re six months or two years out, let’s start the conversation today. Contact us at:

📧 nate@riggsgroupfl.com

📱 IG/FB: @nateriggsofficial

And don’t forget—subscribe to the podcast “This is Jax” on YouTube and Spotify. Let’s hit that goal of 1,000 subscribers by the end of 2025.

Article Links: