The 2008 housing market collapse remains a defining moment in American economic history, with waves of foreclosures and distressed sales reshaping neighborhoods and finances. Fast forward to 2025, and the housing market is navigating its own challenges—high interest rates, affordability concerns, and shifting inventory. But how do distressed sales today compare to the chaos of 2008? Let’s dive into the numbers and explore what’s changed in the world of distressed home sales.

What Are Distressed Sales?

Distressed sales occur when homes are sold under financial duress, typically through foreclosures (bank-owned properties) or short sales (where the sale price is less than the mortgage owed). These sales often signal economic stress and can drag down home prices, making them a key indicator of market health.

2008: The Housing Market’s Dark Days

In 2008, the U.S. housing market was in freefall, reeling from the subprime mortgage crisis. Here’s what the distressed sales landscape looked like:

- Volume: Distressed sales were a massive force, accounting for 45% of all home sales. That’s nearly half the market! Estimates suggest 1.2 to 1.5 million foreclosed homes were sold, with over 3.1 million foreclosure filings recorded nationwide.

- Inventory Overload: Active listings ballooned to 3.5 to 4 million, fueled by a flood of foreclosures and unsold homes. In some hard-hit areas, up to 88% of sales were distressed, making it tough for regular sellers to compete.

- Price Impact: The surge of distressed properties tanked home values, with some markets seeing price drops of 40% or more. Foreclosures and short sales sold at steep discounts, creating a vicious cycle of declining values and more defaults.

The 2008 crisis was a perfect storm: loose lending, speculative buying, and a lack of regulation led to a foreclosure epidemic that reshaped the housing market for years.

2025: A Different Story

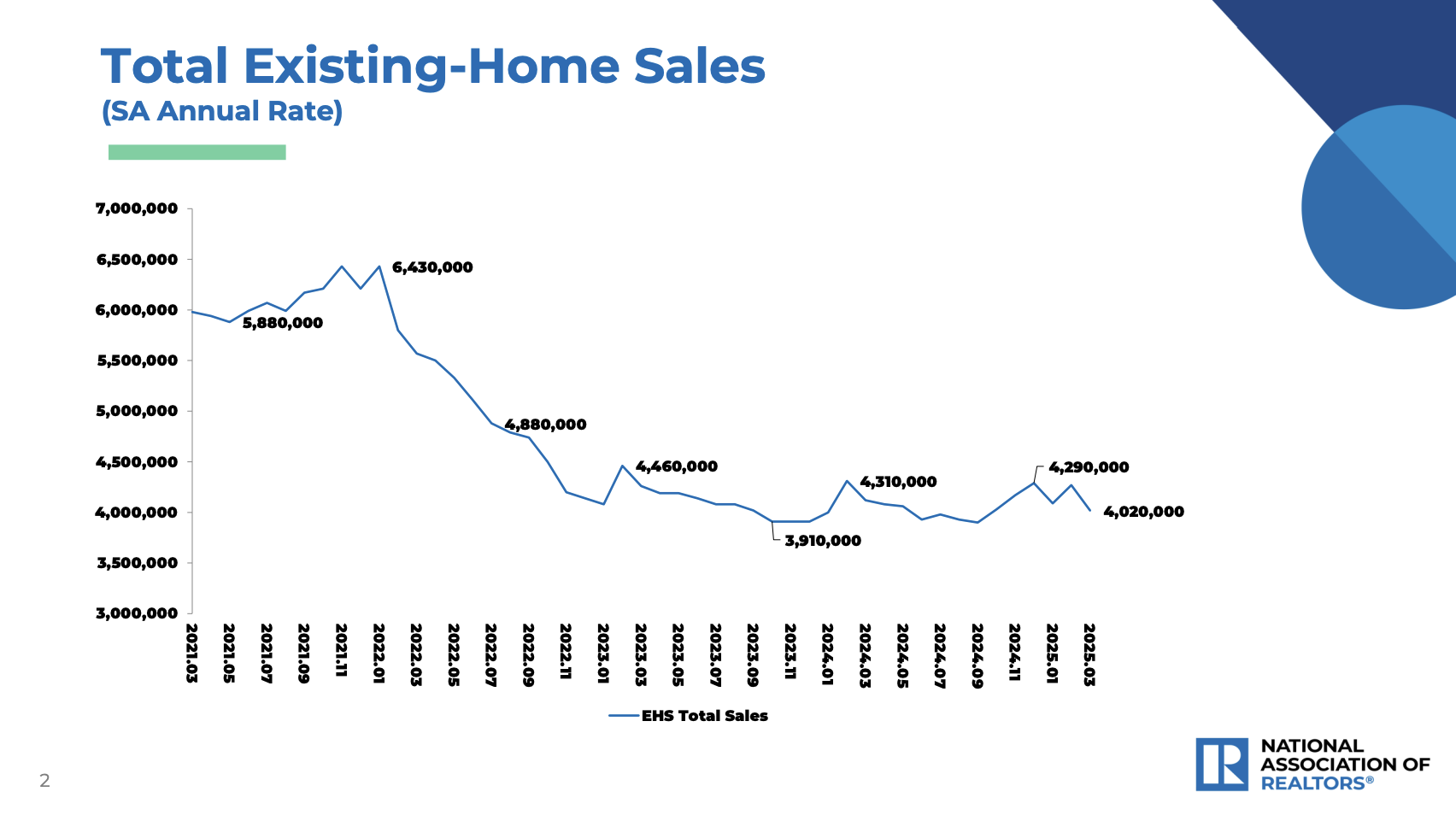

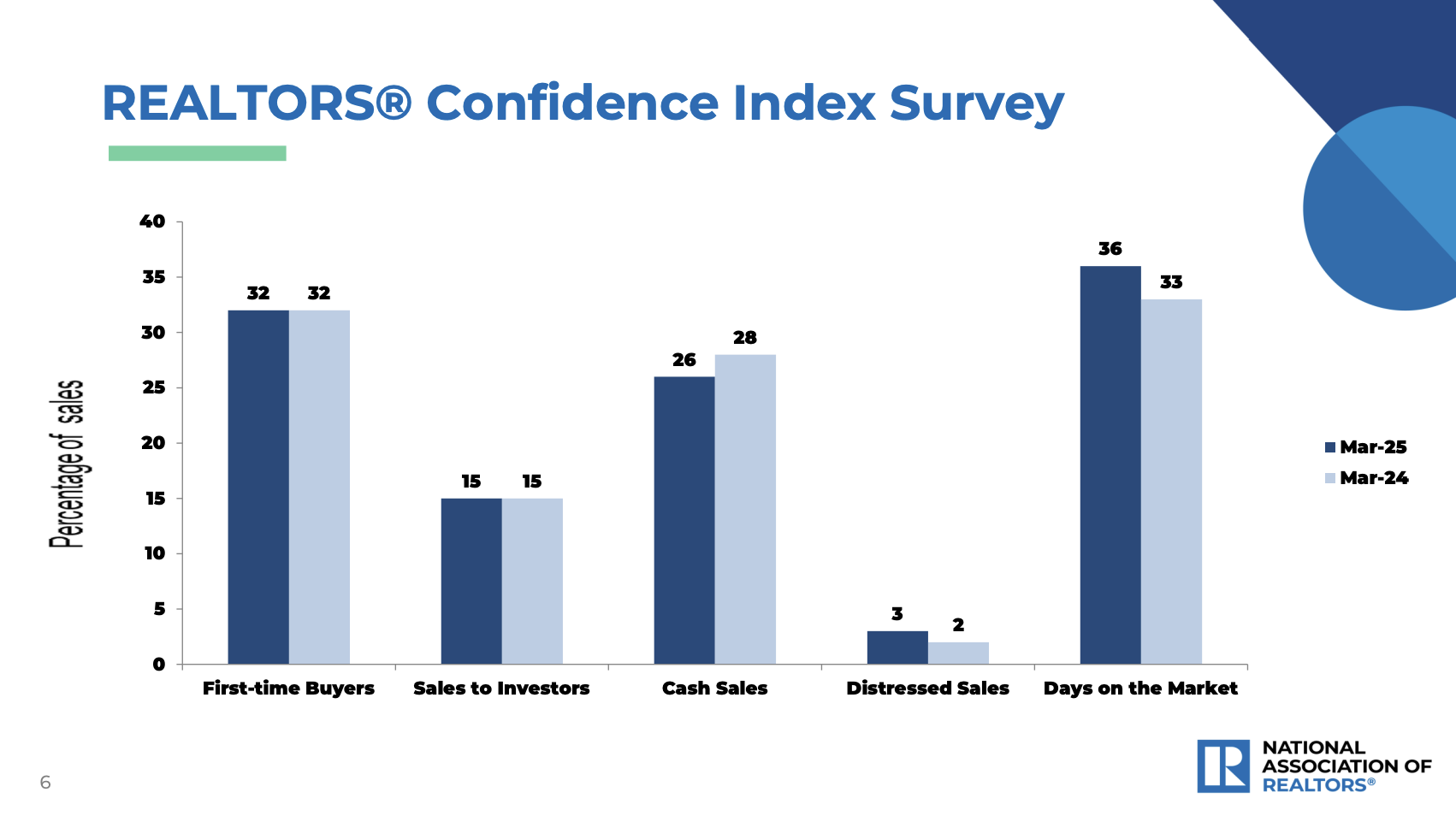

Fast forward to 2025, and the housing market is a far cry from the 2008 meltdown. While high mortgage rates (hovering around 7.5%) and affordability issues pose challenges, distressed sales are a minor player. Here’s the current picture:

- Volume: Distressed sales make up just 1% of total home sales—a stark contrast to 2008’s 45%. Based on projections of 5.6 million total sales for 2025, this translates to roughly 56,000 distressed sales annually.

- Inventory Levels: Active listings in March 2025 stood at 1.81 million (per Redfin), a 15% increase from the prior year but still well below the 3.5–4 million of 2008. This reflects a tighter market with fewer forced sales.

- Price Impact: With distressed sales so low, their effect on home prices is negligible. Some softening is seen at foreclosure auctions, where institutional sellers have adjusted pricing, but overall, low inventory continues to support home values.

Today’s market benefits from stronger homeowner equity and stricter lending standards implemented after 2008. The seriously delinquent mortgage rate is just 1.8%, compared to 10–12% during the crisis years, signaling a much healthier financial landscape.

2008 vs. 2025: A Side-by-Side Comparison

- Volume of Distressed Sales: In 2008, 1.2–1.5 million foreclosures dominated, making up 45% of sales. In 2025, only about 56,000 distressed sales occur, or 1% of the market—a 30- to 40-fold reduction in their share.

- Market Dynamics: The 2008 market was crippled by systemic issues—widespread defaults, toxic loans, and excess inventory. In 2025, the challenges are high rates and low affordability, but distressed sales are a minor factor.

- Economic Impact: Distressed sales in 2008 crushed home prices and prolonged the recession. In 2025, their low volume means they’re barely a blip, though localized markets may see slight auction-related softening.

What This Means for Homebuyers and Sellers

For those navigating the 2025 housing market, the scarcity of distressed sales is both a blessing and a challenge:

- Buyers: Unlike 2008, you won’t find a flood of bargain foreclosures. However, rising inventory (1.81 million listings in March 2025) and slightly softening prices in some areas could offer opportunities, especially if rates stabilize.

- Sellers: Low distressed sales mean less competition from cut-rate properties, but high rates may dampen buyer demand. Pricing strategically and highlighting your home’s value are key.

Looking Ahead

The 2008 housing crash was a cautionary tale of what happens when risk runs unchecked. Today’s market, while not without hurdles, is far more resilient. Distressed sales are at historic lows, and the lessons of 2008—tighter lending, better oversight—continue to protect homeowners and stabilize the market.

As we move through 2025, keep an eye on inventory trends and mortgage rates. While we’re not in a crisis, the market is evolving, and staying informed will help you make smart real estate decisions.

What are your thoughts on today’s housing market? Have you noticed changes in your area? Share your insights with our team today!

Sources: National Association of Realtors, Redfin, Realtor.com, historical foreclosure data from 2008, and 2025 market projections.

5 More Reasons to Move to Jax